Greece-baiting

| The dismal science Economics |

| Economic systems |

| Major concepts |

| The worldly philosophers |

| —The Economist[1] |

"Greece-baiting" was a term coined in early 2012 in a bit of an incoherent screed in anarchist newspaper Freedom Press,[2] but (naturally) certain "thought-leaders" on the Internet reappropriated the concept to address a common[3] trend of right-wing argumentation during the European sovereign debt crisis: such incisive analysts claim that all welfare states (even those offering the bare minimum) are on a slippery slope to Greece, often until one is blue in the face. Greece-baiting is another in a line of association fallacies, and closely related to general anti-Europeanism.

Greek-baiting was rampant in the wait-up to the 2012 U.S. Presidential Election, as the events across the Atlantic had a considerable effect on economic recovery in North America.[note 1] If you've observed Republican politicians declare Barack Obama's policies an attempt to create a "European socialist state" and a "European entitlement society",[4][5] or hear country/province/city X be called "the Next Greece",[6][7][8][9][10][11][12][13][14][15][16][17][18] you've likely been hit with an example. The term was also abused by Tea Partiers as an excuse for shutting down the US government in 2013 to prevent raising the debt ceiling.[19][20] Though it doesn't have to be for any implicit political gain.[21]

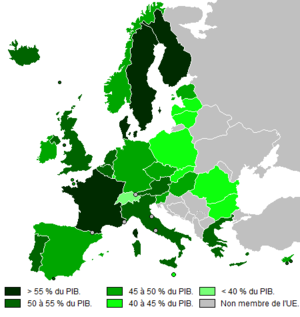

Indeed, Greece obviously committed the sin of years of unsustainable government spending (debatably Keynesian, but no one knows what it even stands for at this point) that contributed to the shitstorm it's in, but the EU's single currency does not necessarily mean homogenous business models; the eurozone is more diverse than you might think.[note 2]

Inconvenient truths[edit]

Raging welfare queens![edit]

The euro crisis has frequently been described as a battle between the work ethics of Southern Europe and its northern neighbours,[22] pointing to the latter's higher GDP growth, productivity levels, and retirement ages,[23] among other factors. It seems to be the smoking gun on blatant benefit scrounging, yet statistics paint a more complex picture — Greeks are working the most hours in the entire continent.[24]

There's also a serious prevalence of tax evasion in the country; its tax burden is almost dead-last in the European Union (31% of GDP in 2010,[25] only a few points away from Canuckistan and some other random landmass[26]). Doesn't exactly scream "high tax, low growth." Even Greece's social expedentures are historically mediocre, barely over the OECD average and handily beaten by Angela Merkel.[27]

Goldman's back[edit]

Considerable debate continues over how much investment firms actually influenced the whole crisis to its climax. It is a well-known fact that Goldman Sachs and other banks were paid off by Greek governments in the beginning of the millennium to hide their moneycopter spree as they were accepted into the monetary union, using the same derivative scamming that screwed over the States.[28][note 3]

This was a clear middle finger to the Maastricht Treaty (requiring all members to maintain no more than a 3% yearly deficit and 60% gross government debt[29]) and if such an act of stupidity was found in time, the Hellenic Republic would have been forced to stick with the drachma...and the Great Recession could have already been a thing of the past. Oh well.

Spain and Ireland[edit]

The Spanish and Irish economies are unique in the GIPSI GIIPS PIIGS in that their entry into this mess wasn't particularly caused by profligate borrowing,[30] but in a similar matter to the US, via the bursting of a housing bubble.[31][32]

Germany itself[edit]

The standard-bearer of the euro is Germany, a social market in its own right, with its labour force working double-time so the beer you're drinking right now isn't double the price.[33] Unemployment levels are the best since Cold War reunification, trade surpluses are up, and there's no sign of it stopping.[34]

However, Germany (along with France) has faced claims of hypocrisy for being the first to violate the Maastricht criteria after the €'s full adoption in 1999.[35][36]

Idiotic Hilarious North American commentators have claimed that Germany will from now on take the lead in European politics or a new golden age for Germany has come[37] (showcasing their complete incompetence concerning European treaties, Germany or economics), a notion that has been dismissed by many German politicians.[38] More inane Christian fundametalists believe that the only reason why Germany is on top of the crisis is because of the "Protestant work ethic" — forgetting that Germany is currently split between Catholicism, Protestantism, atheism and Islam.

Ignoring the Nordics[edit]

No discussion on the eurozone should leave out what the hell is going on in Scandinavia. Contrary to the insistence of laissez-faire economists on the Nordic Model's collapse, it has survived the turmoil relatively unscathed.[39][40] Although the region has accepted free trade and various deregulations since the 1990s, tax rates, unionization rates and public sectors are still the largest in the Western world, as well as consistent balanced budgets.[41][42]

The Swedes, Finns, Danes et al. can too give us an insight on the very inefficiencies of the EU. While the Scandinavian peninsula shares a common interest for a mixed economy, relationships with the euro area vary vastly; Norway takes a eurosceptic position and sticks with pre-existing trade agreements, Sweden and Denmark are Union members but have opted out of anything else (however, the Danish currency is voluntarily, unilaterally paired with the euro), and Finland has done the most, replacing its markka with the legal tender.[43]

And of course, there's Iceland which actually strengthened its welfare state while recovering from its own debt problem. Naturally, it is conveniently forgotten.

At the heart of the crisis: the issue of monetary sovereignty[edit]

A glaring difference between Greece and a number of countries it has been compared to is that the Greeks are not monetarily sovereign, that is, have full control of a fiat currency. As with its eurozone counterparts, it cannot devalue the € to pay off its debt, ceding that ability to the European Central Bank. The ECB, at the same time, has been unable to reciprocate with adequate monetary policy.[44] Most (i.e. Britain[45] and the US[note 4]) have their debt denominated in their own pounds dollars, meaning they can "purchase" their debt for as long as it wants to until the currency is inflated into oblivion.[46] It's one of the reasons why Japan's Lost Decade didn't cause the country to default, despite printing out more cash than Greece.

Which brings us full circle: what happens next? Presuming austerity measures aren't a panacea, there's really only two ways to go:[47]

- Accelerate economic integration within the EU to promote growth, and make the ECB act like the central bank it was supposed to be in the first place; or

- Shut. Down. Everything. (kick the PIIGS out, ultimately risking a full-scale breakup of the euro)

Since the second didn't happen, the logical conclusion is a big one — a commitment to fiscal federalism in the EU.[48] This will likely lead to numerous unintended consequences in the sociopolitical realm, mostly national sovereignty stuff.[note 5]

PIIGS corollaries[edit]

As the worst offenders of the crisis proceed to receive their bailout funding, there's a good chance versions of the neologism could emerge for each nation Never mind.[49][50][51][52]

In fairness[edit]

In an age of Great Depression-style stimulus and worrying outlooks on fiscal health, legitimate allusions to Greece's situation can probably be made, in the proper context. Just don't make it the next Godwin's Law, for fuck's sake.

See also[edit]

- Straw man

- Escape hatch

- Red-baiting

- Fear-mongering

- Naomi Klein: Yes, moonbats do it too.

- Venezuela – A more modern scapegoat for this kind of argument, mixed with red-baiting

External links[edit]

- In Euro Crisis, Fingers Can Point in All Directions, The New York Times

- Europe isn't a Caricature, Dan Gardner

Notes[edit]

- ↑ That's globalization for you.

- ↑ For now.

- ↑ Whether which was worse is a matter of conjecture as well. See Felix Salmon for the "pro-Goldman" side and these guys for the "pro-government" side.

- ↑ Wait, so the Amero isn't real?!!1!

- ↑ Remember that (historically) Europe isn't the most peaceful place in the world, so it's quite an imperative to solve this as quickly as possible.

References[edit]

- ↑ The new Greece is...ID parade, The Economist

- ↑ "Dire Lessons From the Eurozone"

- ↑ "The situation in Greece is alarming, and the situation in all of Europe is alarming, but still the more alarming fact is that most people in Europe cannot still overcome their vanity and admit that Euro has failed, European economies except Germany are stagna—" We're going to cut you off right there.

- ↑ 'Europe' is officially a dirty word in America, BBC

- ↑ Republicans: Obama's Budget Proposal Will Put America On 'A Roadmap To Greece', The Huffington Post

- ↑ Puerto Rico is America’s Greece, Reuters

- ↑ 'America's Greece,' California dreams of raising taxes, CBC

- ↑ Philadelphia Is the Next Greece, Phillymag

- ↑ Niall Ferguson: The Next Greece? It's The US!, Business Insider

- ↑ UK could become the next Greece, warns Next chief executive, The Guardian

- ↑ Ontario is not Greece or Detroit, Metro News

- ↑ Greece and Quebec: More alike than you think!, Toronto Sun

- ↑ Joe Hockey: this Budget will hurt. It’s that or it's Greece, Herald Sun

- ↑ Croatia - the Next Greece, Adriatic Institute

- ↑ Is Hungary the Next Greece?, Wall Street Journal

- ↑ “India Shining”? Or the Greece of Asia?, The American Interest

- ↑ Is Japan the Next Greece?, TheStreet

- ↑ Is China the New Greece?, CNBC

- ↑ Tea Party on Debt Ceiling: ‘Quit Believing Obama’, The Fiscal Times

- ↑ "It may be necessary to partially shut down the government in order to secure the long-term fiscal well being of our country, rather than plod along the path of Greece, Italy and Spain."

- ↑ Football taunting!

- ↑ Myth and Reality About the Euro Crisis, WSJ

- ↑ Merkel Blasts Greece over Retirement Age, Vacation Der Spiegel

- ↑ Are Greeks the hardest workers in Europe?, BBC

- ↑ Taxation trends in the European Union, Eurostat (Greece summary)

- ↑ See the Wikipedia article on International government spending as a percentage of GDP.

- ↑ Is the European Welfare State Really More Expensive?, OECD. Prepare to read over 100 pages! (older data)

- ↑ Goldman Sachs faces Fed inquiry over Greek crisis, The Guardian

- ↑ Convergence criteria, ECB

- ↑ Eurozone crisis explained, BBC

- ↑ When Irish Eyes Are Crying, Vanity Fair

- ↑ Q&A: Spain's woes, BBC

- ↑ No, really

- ↑ The European debt crisis in eight graphs, Washington Post

- ↑ The Ticking Euro Bomb: How the Euro Zone Ignored Its Own Rules, Der Spiegel

- ↑ Did Germany sow the seeds of the eurozone debt crisis?, BBC

- ↑ Conrad Black: The German hour has come at last, National Post

- ↑ Germany Grapples With Role in Rescue, WSJ

- ↑ Scandinavia: Where Did It All Go Right?, WSJ

- ↑ Why Scandinavia can teach us a thing or two about surviving a recession, The Guardian

- ↑ The Nordic Way, World Economic Forum

- ↑ The Nordic Model: Conditions, Origins, Outcomes, Lessons, Hertie School of Governance

- ↑ They might be beginning to regret it.

- ↑ Start the engines, Angela, The Economist (More info

on Wikipedia)

on Wikipedia)

- ↑ Scots, What the Heck?, The New York Times (Describing the drawbacks of an independent Scotland retaining the pound)

- ↑ Why We Aren't Like Greece, Dean Baker

- ↑ The euro zone crisis: Its dimensions and implications, Indian Ministry of Finance

- ↑ How to finish the euro house, Center for European Reform

- ↑ Will Italy be next Greece?, Xinhuanet

- ↑ Is Spain the Next Greece?, WSJ

- ↑ Portugal Is the Next Greece, The New York Times

- ↑ Is Ireland the next Greece?, Time